NSR’s Polar Satellite Markets, 2nd Edition new June report, reveals more than $1.7 billion in revenue growth generated by the Arctic and Antarctic regions across a range of applications and frequency bands, driven by new bandwidth and capacity opportunities. Maritime demand will drive the growth of this nascent market, resulting in a 12-fold increase of commercial mobility capacity revenues alone between 2015 and 2025, albeit from a low base.

Alan Crisp, NSR Senior Analyst and report lead author commented that while the Polar regions are a niche market in and of themselves, the latent demand, lack of competition, and great need for connectivity combined presents favorable opportunities to those who are willing to accept the higher risks and technical challenges of operating in the region. Despite the challenges, such as small populations and lack of telecomm infrastructure, there are certainly opportunities for growth.

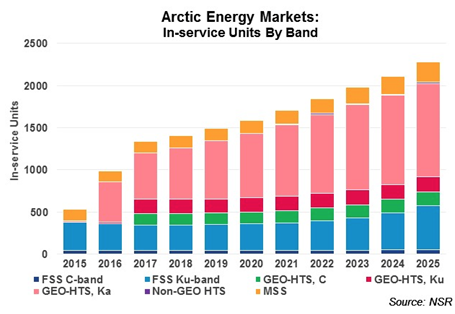

Operators with HTS capacity will be the largest winners, bringing new revenue opportunities to these unconnected and under-connected markets, with the region seeing $116M in HTS revenues by 2025. Latent demand for this greater bandwidth will drive revenue growth when GEO-HTS and LEO-HTS solutions become available to Arctic residents and enterprises alike.

In addition to the opportunities in the GEO orbital arc, LEO-HTS will see a potential market develop due to lower cost of capacity, as well as coverage that is better-suited for higher latitudes. This is especially the case where the lower cost per bit will result in a more compelling proposition for government-backed USO programs, which could lead to greater levels of spending for regional and remote communities.

These revenue opportunities will not come without challenges. Regulatory, technological, and distribution challenges to the business case remain. In the Polar Regions in particular, LEO-HTS will also find a lack of significant population as a major barrier to establishing a significant market presence, even with substantial capacity being offered. By contrast, challenges relating to look angles, ‘snow fade’, and limited supply availability will result in a steady FSS market in the Arctic, dominated by DTH and Video Distribution demand.t

This industry benchmark report provides readers with a comprehensive picture of the Polar satcom to date with more segmentations the edition includes a new split of supply and demand into Arctic and Antarctic regions, as well as data segmented by application, vertical and frequency band.

This report answers key questions concerning Polar markets:

- How will usage demand shift over time across 12 applications?

- Where is the greatest level of latent demand in connectivity, and what will result when additional supply becomes available?

- What is the best way to serve demand coming from the Antarctic?

- How would potential satellite constellations affect the current and future supply dynamic in the Arctic?

- How underserved are the broadband markets in far north regions?

- What are the revenue prospects for each vertical and application?