On April 8th, the sale transaction of MDA by Maxar Technologies (NYSE:MAXR)(TSX:MAXR) to a consortium led by Toronto-based investment firm Northern Private Capital (NPC) has officially closed.

This marks the return of MDA to Canadian control as a private, independent company headquartered in Canada. Founded in 1969, MDA is Canada’s largest space technology developer and manufacturer, with more than 1,900 employees across the country.

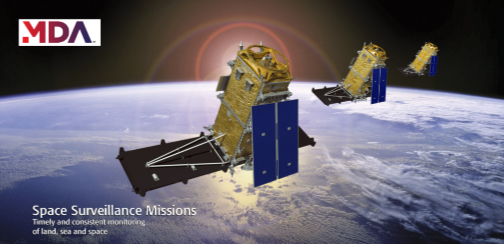

Through a strong collaboration and partnership with the Government of Canada that spans several decades, MDA has delivered world-leading, iconic technologies such as the Canadarm family of space robotics for the U.S. Space Shuttle program and the International Space Station and three generations of RADARSAT Earth Observation satellites for the Canadian Government.

As a stand-alone company, MDA is one of the largest independent suppliers of space components and systems in the world, enabling it to be a merchant supplier to international prime contractors and partner to governments around the globe who are investing in and growing their space programs.

Mike Greenley

NPC, led by John Risley and Andrew Lapham, has appointed Mike Greenley as Chief Executive Officer of MDA and he said he is very proud to lead MDA at such a pivotal moment in this great company’s history. It is inspiring to be associated with such eminent Canadian business leaders who share in a vision to turn MDA into a global powerhouse. MDA is truly a made-in-Canada success story with global growth potential resulting from its industry-leading technologies across multiple segments of the growing space sector. The company is excited to roll up our sleeves with MDA leadership to help shape its future evolution and expansion. Greenley added that the company is open for business. As a space company with a big Canadian flag on the firm's backpack and decades of experience in the space sector building first-of-a-kind space systems, MDA's ability to partner and collaborate will be unmatched.

The NPC-led consortium has acquired all of MDA’s operations across Canada and the UK. The transaction value was CAD$1 billion and was financed with a combination of equity and debt. Equity was provided by NPC and certain of its limited partners, as well as several leading investors including Fonds de solidarité FTQ, Jim Balsillie, Bulldog Capital Partners, Albion River, Nicola Wealth and Senvest Capital, along with funds managed by Senvest Management. NPC was advised on the transaction by Bank of Montreal and Scotiabank. Scotiabank and Bank of Montreal also led the senior debt financing, and PointNorth Capital and Canso Investment Counsel provided the junior debt.