As the Satellite & Space sectors face the same challenges as the rest of the economy, one market seems particularly robust in the face of COVID-19 – Government & Military Satellite Communications services.

With ongoing procurement for next-gen MILSATCOM technologies from U.S. Space Force, the commercial opportunities continue. While the future remains uncertain, compared to other mobility-centric satellite end-user markets, Gov & Mil appears to remain insulated from larger world events.

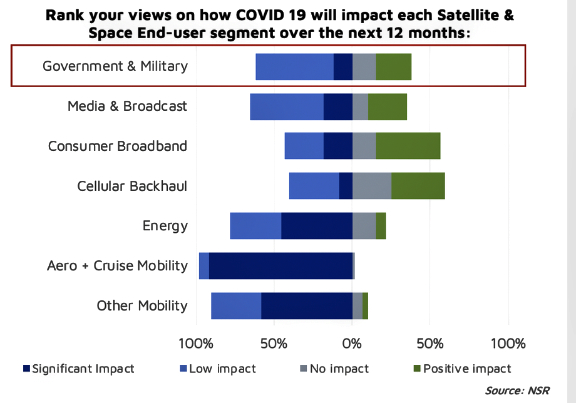

According to a recent survey conducted by NSR across a wide variety of the Satellite & Space sector value-chain, Gov & Mil markets was identified as one end-user vertical that is expected to see some of the lowest levels of significant impact, and some of the few markets with an expected positive impact from COVID-19 to the Satellite & Space value-chain.

Just as armed conflicts generally boost consumption of satellite services by Gov & Mil end-users (think the 2008 troop surge for Global War on Terror), this different fight appears no different. Facing a multi-faceted challenge of the immediate requirements for connectivity to enable telemedicine and response coordination, continuing procurement activities appear to be a key pillar of the economic response for governments around the world.

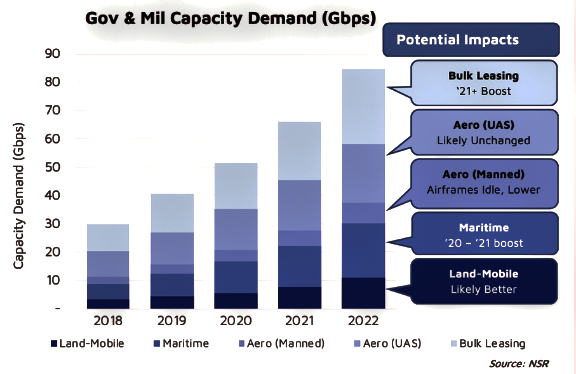

Moreover, as NSR continues to evaluate how rapidly changing world events are impacting markets today, and long-term ramifications – NSR's Government & Military Satellite Communications, 16th Edition report appears to remain largely unimpacted right now. There are segments of the market that are naturally feeling pressures – world leaders are not traveling as much and thus their fleet of highly connected vehicles are idle now – yet, that capacity is quickly getting reallocated towards other missions or applications.

As we have seen with the reallocation of capacity for the USNS Mercy and, more recently, USNS Comfort, quickly reallocating capacity can occur, yet at the expense of the current users of MILSATCOM capacity from systems such as WGS.

If there are any long-term trends to emerge from the COVID-19 response so far, robust communication networks are a must-have. More than ability to deploy engineers onsite and quickly reallocate resources from one platform to another – multi-band and multi-network ground infrastructure will become a key enabling technology to meet the multi-domain requirements of Gov & Military operations.

What is unclear is the balance between Gov-owned and Gov-Leased capacity.

With the Space Development Agency moving forward with Industry Days for their proliferated LEO “Transport Layer” and an RFP release slated for May 1st, the market is waiting to see if the U.S. DoD can provide another lifeline to the LEO Space Market. As with early-days of Iridium, can SDA’s Transport Layer provide the much-needed ‘steady consumer’ on either the spacecraft hardware or connectivity business models required to bring these dreams to reality? Bottom Line

In these uncertain times, Governments are taking significant economic action to boost domestic industries – from increased or ongoing procurement to direct stimulus. With all that was happening in the Satellite & Space sector before COVID-19, the near-term outlook for this market continues to be one of the few positive spots across the value-chain. From potential spacecraft sales in the post-OneWeb world to spending on enhanced ground infrastructure to more bandwidth demand – there remain reasons to be optimistic on the growth opportunity for Gov & Mil players.

Brad Grady

Article author: Brad Grady, NSR Analyst