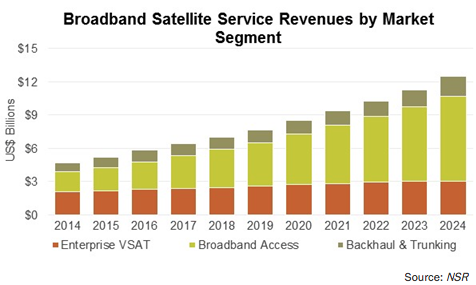

[Satnews] The mood at last week’s Satellite 2016 conference was one of an industry heading towards a profound transformation. HTS is changing the rules of the game and only the fittest may survive. Capacity pricing was definitely the buzz word in all conversations, but the key question is: can the lower capacity pricing unleash enough demand to keep growing revenues? NSR believes that new price points will in fact stimulate demand from previously locked markets and the overall broadband revenues will grow considerably in the years to come. In NSR’s VSAT and Broadband Satellite Markets, 14th Edition report, service revenue for fixed broadband markets are forecast to grow at CAGR 10.2 percent over the next 10 years to pass the US$12 billion mark by 2024.

The industry has previously gone through periods of price fluctuations to balance supply and demand, but this era it is a completely different story. HTS is introducing a major technological shift in the industry, significantly cutting the cost per MHz in orbit, and operators are rushing to launch capacity to capture the new broadband demand emerging. This downward trend in pricing will continue if not accelerate if next generation ultra HTS satellites and LEO constellations enter into service.

Capacity pricing in the satellite industry has generally been stable, but taking a step back and looking into the global telecom industry, average global bandwidth pricing has declined at a 27 percent per year pace according to the Deloitte 2013 shift index. If the satellite industry wants to remain relevant in the global broadband picture, it too needs to cut prices dramatically.

The World Just Wants More Data!

Global IP traffic has boomed since the inception of the Internet. According to Cisco, global IP traffic grew at a 29 percent rate from 2010 to 2015. Despite the satellite industry having done fairly well in the same period, growing capacity at 11.8 percent CAGR, it is obvious the satellite industry is continuously losing ground in favor of other technologies and today, a mere 0.15 percent of the global IP traffic crosses the global satellite network. However, looking forward, as ground networks struggle to extend further their footprints and satellite connectivity becomes affordable, NSR expects this share to slowly grow in the coming years.

The experience from other ICT markets is that a data service available at affordable prices has been consumed. As household broadband speeds grew, content has evolved rapidly, changing from emailing and web browsing to sharing photos and eventually video on demand. Going forward, with Virtual Reality, Spherical Videos, UHD and other bandwidth-hungry applications becoming more mainstream, “bandwidth-hungry-ness” in the consumer space will continue to lead to service providers shopping around for the cheapest yet reliable data service available.

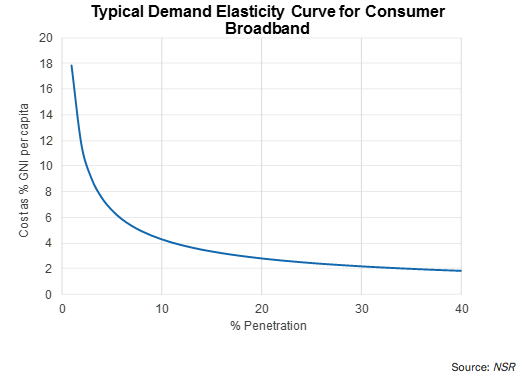

But what does affordable exactly mean? The Broadband Commission (ITU, UNESCO) uses 5 percent of GNI per capita as a common threshold for broadband affordability. Multiple research efforts show that consumer broadband demand is fairly inelastic until it drops below 5 percent of GNI, at which point penetration rises rapidly. Be it through Trunking, Mobile Backhaul or Consumer Broadband, HTS brings the possibility to offer services below this threshold, opening up large untapped demand.

Towards a Bigger Pie or Revenue Cannibalization?

Again looking into other ICT industries that have followed comparable trends in the past, the mobile industry in Sub-Saharan Africa has increased revenues by 7 percent in the 2010-2015 period through lowering ARPUs and attracting more subscribers. With subscriber net adds slowing, revenue growth will also decline. Conversely, in developed markets like North America or Europe where penetration is saturated and it is difficult to add new subscribers, revenues are stagnated or declining. ARPUs are kept stable, but data traffic per user is growing considerably, effectively dropping the price per Mb. The lesson learned for the satellite industry: it is easier to grow revenues when decreasing the cost of capacity when the growth is based on adding new subscribers, rather than when it depends on selling premium services to the same customer base.

Experience in the satellite industry resonates well with those assumptions. ViaSat was able to achieve solid revenue growth during the subscriber growth phase but with beams saturating and the focus moving towards high-end subscriptions, revenues slowed down.

The good news for satellite companies is that, for this wave of HTS satellites, the focus will be on adding new clients in the form of consumer broadband subscribers, mobile broadband backhaul sites or mobility platforms. NSR forecasts in its VBSM14 report that over 8.9 million new fixed broadband subscribers and sites will be added in the next 10 years, thus creating large opportunities for revenue growth despite the pressure on pricing.

Bottom Line

Downward price trends are a general concern within the satellite operator community. New technologies are reshaping the industry, and operators need to adapt to the new environment. This is not part of a cyclical supply and demand balance but a major technological & industry shift, and the downward pricing trend is here to stay bringing both opportunities and challenges.

ICT markets have generally shown high demand elasticity. Consumers tend to use as much capacity as available at affordable levels, and 5 percent of GNI per capita is generally accepted as the turning point where broadband demand booms. As one target for satellite is low-income rural populations, business models need to adapt by adopting innovative solutions like demand aggregation at the hotspot or pre-paid solutions.

In the broadband markets, it is easier to drive revenues up in a scenario of downward capacity pricing by adding new subscribers rather than on moving clients to premium services. NSR expects the new price points to unlock markets, attracting new sites and subscribers and creating opportunities for revenue growth.