It later announced a pre-paid service for voice and data transactions originating in the U.S. and its territories that will help push subscriber numbers. For a business that cost the Company nearly $100 million to establish, Inmarsat is hard-pressed to show a positive bottom line for its handheld business, and pre-paid usually grows the number of subs quickly. But will it grow revenues faster to recoup their investment and kick-start a so-so year for the satellite phone market?

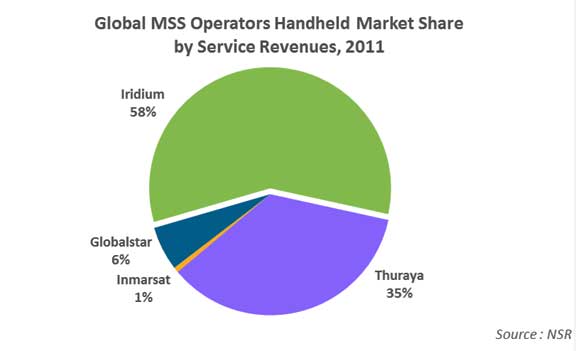

In its recently released Mobile Satellite Services, 8th Edition, NSR noted that, thanks to the entry of Inmarsat in the business in June 2010, there has been a positive impact on the number of in-service handheld units in the global satellite phone market. At the same time, while Iridium subscribers overall grew, it has lost government and military customers recently. The subscriber counts and service revenues seem to also have suffered at Thuraya, while Globalstar still has not recovered their lost voice customers.

What is unfortunate in this low growth scenario is that the global subscriber count has remained fairly flat over the past year, and Inmarsat had no significant impact on service revenue growth due to underperforming ARPU levels. Even Iridium’s ARPU decreased in 2011 as users pulled back their usage in both the commercial and government segments.

With the pre-paid plans on phones based in the U.S., a key market for satellite handsets, Inmarsat noted that the target of the promotion is ‘short-term or seasonal’ workers that do not want to “commit to a contract”. This is not likely to help the market from what we believe was a so-so 2011 and up to now, a rather poor 2012.

Is the pre-paid model an insurance of future revenues? It will likely grow subscribers for a while and offload large phone inventories, but the impact on revenues is not expected to be significant. At an ARPU level that is estimated to be the lowest in the industry, there is a risk with this promotion that it will remain low.

The pre-paid model is well known in the satellite business, and seasonal workers and outdoor enthusiasts use it in the summer, in North America especially. Thus, the push by Inmarsat makes sense to increase its market penetration, in a market dominated by generally pricier Iridium services. However, Thuraya endured a painful experience in the Middle-East and Africa when they found these types of customers do not stay after their minutes are gone. They may renew for a few years, but with well over 600,000 Thuraya handsets sold, less than one-third are subscribers generating revenues today. It is the textbook case of the pitfalls of the pre-paid model, which shows the significant gap to migrate users to post-paid plans, which are those that generate higher recurring revenues.

The push for pre-paid subscriber additions is a given for Inmarsat, and it will give the operator some kick for its smartly-priced handsets while decreasing inventory. However, it will also have to significantly increase ARPU levels with these or post-paid subscribers to relieve itself from the growing pain it is experiencing on the handset service revenues side of the business.